Investing can be a daunting prospect for those new to the game. The world of finance can seem complex and overwhelming, but with the right approach, anyone can begin their journey towards building wealth through investments. By following some key principles and strategies, you can set yourself up for success and navigate the world of investing with confidence.

Understanding Your Financial Goals

Before diving into the world of investing, it is crucial to take the time to understand your financial goals. What are you investing for? Are you looking to save for retirement, buy a house, or simply grow your wealth? By defining your financial goals, you can tailor your investment strategy to align with your objectives. Having a clear sense of purpose will help guide your decisions and keep you focused on your long-term aspirations.

Start Small and Diversify

When starting out as an investor, it’s essential to begin with a conservative approach. Instead of diving headfirst into high-risk investments, consider starting small with safer options such as index funds or exchange-traded funds (ETFs). These types of investments offer a diversified portfolio, spreading risk across a range of assets. Diversification is key to managing risk and protecting your investments from market volatility. By spreading your investments across different asset classes, you can reduce the impact of any single investment underperforming.

Educate Yourself

One of the most valuable tools in your investing arsenal is knowledge. Take the time to educate yourself about the basics of investing, different investment vehicles, and market trends. There are a wealth of resources available, from books and online courses to financial advisors and investment forums. By staying informed and continuously learning, you can make more informed decisions and adapt your strategy as needed.

Set a Budget and Stick to It

Investing should be a calculated decision based on your financial situation and goals. Before investing any money, it’s crucial to set a budget and determine how much you can comfortably afford to invest. Avoid investing money that you may need in the short term or that would put you in financial jeopardy if lost. By setting a budget and sticking to it, you can avoid taking unnecessary risks and ensure that your investments align with your overall financial plan.

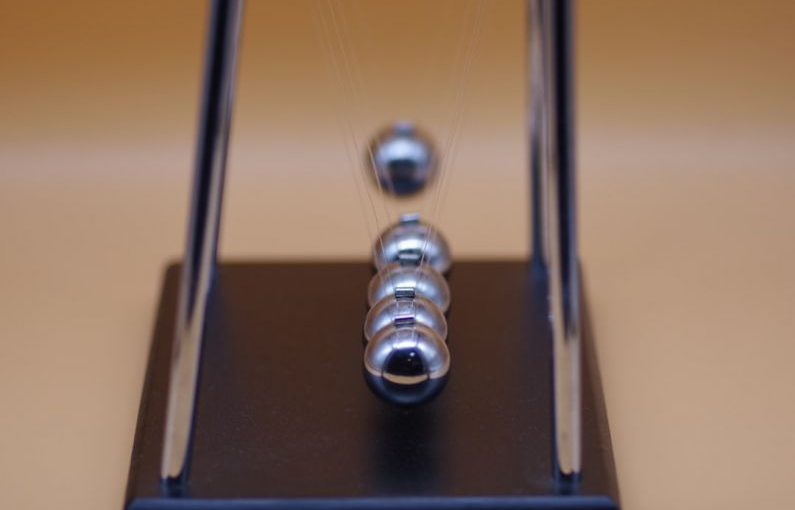

Stay Calm During Market Fluctuations

The stock market can be volatile, with prices fluctuating daily based on a myriad of factors. It’s essential to remain calm and avoid making emotional decisions during market fluctuations. Instead of panicking and selling off investments during a downturn, take a long-term view and consider the bigger picture. History has shown that markets tend to recover over time, and staying invested for the long haul can help you ride out short-term fluctuations.

Monitor Your Investments Regularly

While it’s essential to maintain a long-term perspective when investing, it’s also important to monitor your investments regularly. Keep track of how your investments are performing and make adjustments as needed to stay on course with your financial goals. Rebalancing your portfolio periodically can help ensure that your investments remain diversified and aligned with your risk tolerance.

The Road to Financial Freedom

Embarking on your investing journey can be both exciting and intimidating. By starting on the right foot with a clear understanding of your financial goals, a diversified investment strategy, and a commitment to ongoing education, you can set yourself up for success. Remember to stay disciplined, stick to your budget, and remain calm during market fluctuations. With time, patience, and a strategic approach, you can pave the way towards financial freedom and security.